Your Location > Home > News & Market >Domestic News > Aluminum, Steel and the Difference Between Miners and Manufacturers(3)

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

Domestic News

Aluminum, Steel and the Difference Between Miners and Manufacturers(3)

- China Aluminium Network

- Post Time: 2010/1/7

- Click Amount: 661

X 5-year chart:

X 1-year chart:

X 3-month chart:

This chart shows there is good support at about $46 for US Steel. This might be a good target point for your short, although it could certainly go lower. Still $11+ is a good profit. X is also far above its 50-day SMA. It has not gone more than about 2.5 months in the last year without crossing it. It has been about 2 months since the last cross. This is another reason it may go down.

SLX ETF 1-year chart:

The SLX chart does not show particular weakness in the steels rally yet. This is probably reason to worry about shorting X. More pronounced weakness in SLX would be good. However, much of the profit in an X short would likely be gone before the stronger steels started to fade noticeably.

The London Metals Exchange charts for the two sets of steel prices show the price has not been rising much lately.

The cash buyers Far East Steel Price Chart:

The cash buyers Mediterranean Steel Price Chart:

Neither of the London Metals Exchange Steel Price charts show appreciable price movement upward in the last two months.

Many analysts consider both US aluminums and US steels far overpriced. The only thing that has kept them from falling so far is the HYPE that the economy is going to recover quickly in 2010. I think everyone knows this is not true. They know the strong demand of vibrant worldwide, US, and European economies is a long way off. Yet somehow they have maintained the fantasy that it is happening immediately (a “V-shaped” recovery). Not many still believe this.

In fact many of the pundits I have read lately believe an extended period of poor performance is coming. Many believe China is facing a slowdown soon. China has already moved to tighten credit to combat a real estate bubble of its own. If a bubble bursts, it will hurt steel. If the USD carry trade ends, it could pressure Chinese manufacturing significantly, especially steels. If the export market does not return for China by mid 2010, China may slow down based on that.

In each case a China slowdown would mean a flood of even cheaper Chinese steel exports onto the market. This would mean trouble for US steels. It seems likely one or more of these possibilities will occur to some degree. US steels are likely to be pressured significantly in FY2010 by China and others. This will put significant pressure on their margins, profits, and revenues. X is a short to me, but it may not be to those who see US steels makers only as a commodity plays. I have tried to point out why they are not. Many are saying the price of materials to make steel have been rising, so steel must rise. This is a specious argument with an iota of truth to it. The London Metals Exchange Far East chart seems to have prices falling lately.

US and Canadian potash makers have recently had their legs cut out from under them on price by Brazilian and Russian potash. I would not care to speculate how long this will last in this article. However, the same type of thing could easily happen in steels. Up is obviously a preferred direction, but it is not the only direction. Potash FY2010 multiples are at least reasonable. X’s FY2010 multiple is not reasonable, especially given the large number of uncertainties. Even the high multiple has high uncertainty.

US aluminum makers are in roughly the same situation as steel. One of the most fundamentally overpriced US aluminums is Century Aluminum (CENX), which has a FY2010 PE of 41. Its FY2010 earnings are also very uncertain.

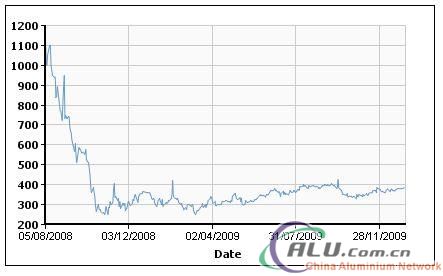

Its chart looks a bit more toppy than X’s. I regard CENX as a short candidate also.

Source: CENX- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.