Your Location > Home > News & Market >International News > LME aluminium slips further on rising inventory and US dollar; SHFE drops in absence of strong fundamentals

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

LME aluminium slips further on rising inventory and US dollar; SHFE drops in absence of strong fundamentals

- China Aluminium Network

- Post Time: 2018/10/18

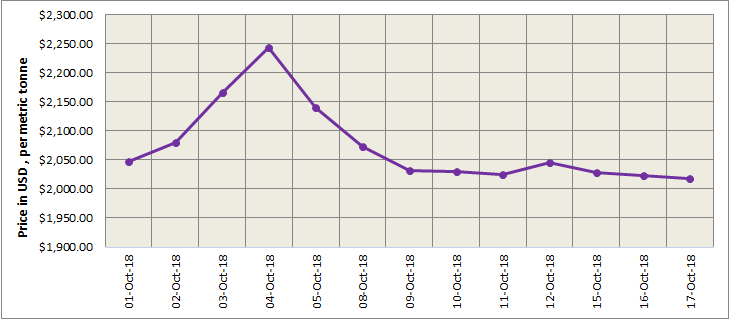

- Click Amount: 922

The US dollar gained on Wednesday as stocks dipped, boosting demand for safe haven currencies, after the Federal Reserve released minutes from its September meeting. LME base metals, except for zinc, ended in negative territory across the board on Wednesday. An increase of 85,725 tonnes in LME inventory, following a rise of 70,775 tonnes in the previous day, dragged the contract to an intraday low of US$2,015 per tonne. Aluminium slipped 0.7% to finally close at US$ 2018 per tonne on October 17 from US$ 2022 per tonne on Tuesday, October 16. Given the strong dollar, LME aluminium is likely to trade under pressure today between US$2,010-2,040 per tonne.

As on October 17, LME aluminium cash (bid) price stands at US$ 2017.50 per tonne, LME official settlement price stands at US$ 2018 per tonne; 3-months bid price stands at US$ 2023 per tonne, 3-months offer price is US$ 2023.50 per tonne; Dec 19 bid price stands at US$ 2075 per tonne, and Dec 19 offer price stands at US$ 2080 per tonne.

The LME aluminium opening stock increased further to 1082600 tonnes. Live Warrants totalled at 775825 tonnes, and Cancelled Warrants were 306775 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 2039 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased to US$ 2031 per tonne today from US$ 2064 per tonne on October 17.

There was limited upward momentum after the SHFE 1812 contract rose to an intraday high of RMB 14,345 per tonne, buoyed by rising longs. It hovered around RMB 14,305 per tonne, and closed at RMB 14,300 per tonne. Smaller support from costs and poorer downstream consumption are expected to limit its upward potential in the short run. The SHFE 1812 contract then fell overnight and closed near session lows of RMB 14,120 per tonne today morning.

The US Department of Commerce (DOC) announced late last week that it had initiated anti-dumping and countervailing duty investigations on imports of aluminium wire and cable from China. Domestically, the winter smog-control plan issued by Henan province suggested that the aluminium industry would be largely exempt from curbs this year. The developments have weighed on both SHFE and LME aluminium prices. The SHFE 1901 contract is likely to remain weak today with a trading range of RMB 14,050-14,200 per tonne. Spot discounts are seen at RMB 50-10 per tonne.

Source: https://www.alcircle.com/- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.