Your Location > Home > News & Market >International News > LME aluminium continues downward trend; SHFE to trade at RMB14,150-14,300/t today

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

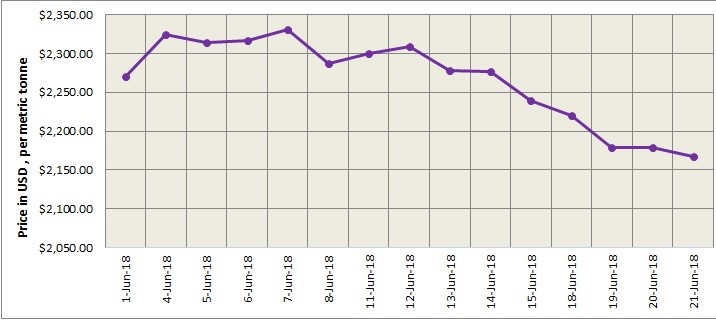

LME aluminium continues downward trend; SHFE to trade at RMB14,150-14,300/t today

- China Aluminium Network

- Post Time: 2018/6/22

- Click Amount: 556

LME aluminium rebounded to a high of US$2,193 per tonne from a session-low of US$2,162.5 per tonne overnight. Benchmark aluminium price on London Metal Exchange dropped to close at US$2167 per tonne on Thursday, June 21. SMM sees pressure at the five-day moving average and support at the US$2,160 per tonne level. The metal is likely to trade rangebound at US$2,165-2,196 per tonne today.

As on June 21, LME aluminium cash (bid) price stands at US$ 2166 per tonne, LME official settlement price stands at US$ 2167 per tonne; 3-months bid price stands at US$ 2165 per tonne, 3-months offer price is US$ 2166 per tonne; Dec 19 bid price stands at US$ 2190 per tonne, and Dec 19 offer price stands at US$ 2195 per tonne.

The LME aluminium opening stock slightly dropped to 1131100 tonnes. Live Warrants totalled at 888025 tonnes, and Cancelled Warrants were 243075 tonne.

LME aluminium 3-months Asian Reference Price is hovering at US$ 2166.83 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 2173 per tonne on June 22 from US$ 2175 per tonne on June 21.

The SHFE 1808 contract hovered at RMB14, 225 per tonne after it climbed to a high of RMB14, 270 per tonne. It closed at RMB14, 185 per tonne. SMM expects it to test support at RMB14, 000 per tonne in the short term.

As seen by SMM, the SHFE 1808 contract hit a high of RMB14, 265 per tonnes last night after touching a low of RMB14, 165 per tonne. It is likely to test support at the five-day moving average today with a trading range at RMB14, 150-14,300 per tonne. Spot discounts are seen at RMB60-20 per tonne.

The US dollar index slipped and closed at 94.85 overnight with weaker-than-expected US economic indicators. Key factor to watch today include the preliminary June reading of the Markit manufacturing purchasing managers’ index (PMI) for eurozone and the US.

Source: https://www.alcircle.com- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.