Your Location > Home > News & Market >International News > LME aluminium consolidates on news of Deripaska’s exit from Rusal and strong greenback; SHFE to stay rangebound

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

LME aluminium consolidates on news of Deripaska’s exit from Rusal and strong greenback; SHFE to stay rangebound

- China Aluminium Network

- Post Time: 2018/5/21

- Click Amount: 570

Russian oligarch Oleg Deripaska quit the boards of EN+ and its subsidiary Rusal on Friday. The action is expected to ease the sanctions on Rusal soon. As the US treasury yield climbed, the US dollar index rose 1.2% to close at 93.66 and reached a new high at 93.83 since December 2017 on Friday.

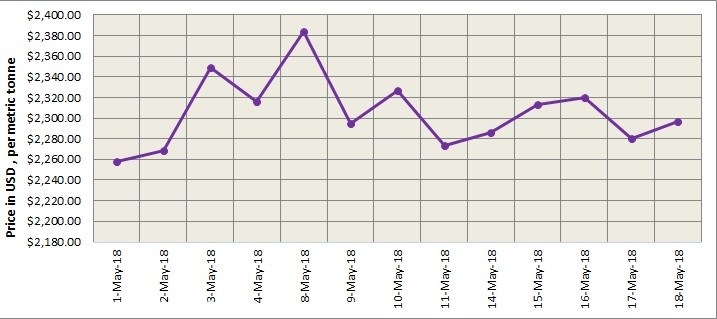

Base metals saw mixed trading on higher US dollar price, but LME aluminium went up slightly. LME aluminium received support and closed at US$ 2297per tonne on May 18 from US$ 2280 per tonne on previous closing. Shanghai Metals Market expects LME aluminium to face resistance at US$2,300 per tonne level and the contract is likely to trade at US$2,250-2,295 per tonne today.

As on May 18, LME aluminium cash (bid) price stands at US$ 2296.50 per tonne, LME official settlement price stands at US$ 2297 per tonne; 3-months bid price stands at US$ 2293 per tonne, 3-months offer price is US$ 2293.50 per tonne; Dec 19 bid price stands at US$ 2247 per tonne, and Dec 19 offer price stands at US$ 2252 per tonne.

The LME aluminium opening stock slightly increased to 1243850 tonnes as traders are little relaxed on the sanctions on Rusal. Live Warrants totalled at 968150 tonnes, and Cancelled Warrants were 275700 tonne.

LME aluminium 3-months ABR price is hovering low at US$ 2280.47tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped slightly from US$ 2302 per tonne on May 18 to US$ 2296 per tonne on May 21.

The SHFE 1807 contract initially tumbled to a low of RMB 14,770 per tonne on Friday as longs took profits and closed out their positions. The contract then remained rangebound within a narrow range for the rest of the day. Finally, the SHFE 1807 contract touched a low of RMB 14,750 per tonne last Friday night as shorts sold at high levels. It then rebounded to RMB 14,790 per tonne as shorts suspended their sell-off. SMM expects SHFE aluminium to test support at the 10-and 20-day moving averages today with a trading range at RMB 14,650-14,850 per tonne. Spot discounts are seen at RMB 100-60 per tonne.

SHFE is expected to continue strong and stay rangebound considering its relatively balanced fundamentals and a lack of macroeconomic developments. The US dollar is likely to extend its gains today as the US and China put the trade war “on hold”, according to US Treasury secretary Steven Mnuchin. Base metals are not expected to perform bullish due to the strong greenback.

Source: https://www.alcircle.com- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.