Your Location > Home > News & Market >International News > LME aluminium resumes downward trend; climbing inventory jeopardizes SHFE aluminium

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

LME aluminium resumes downward trend; climbing inventory jeopardizes SHFE aluminium

- China Aluminium Network

- Post Time: 2018/3/14

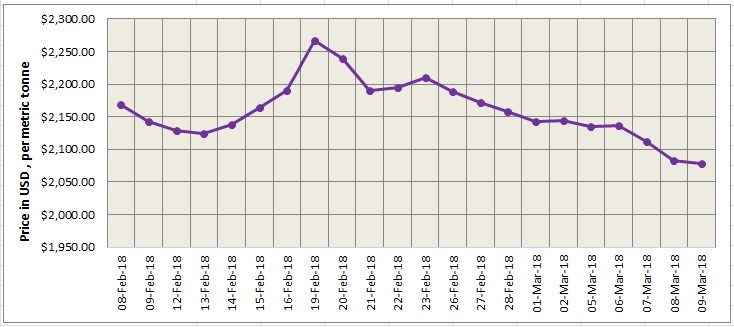

- Click Amount: 592

After a modest gain on Monday to US$ 2097 per tonne, LME aluminium resumed its downward trends and closed at US$ 2080 per tonne on Tuesday 13 March. As updated by Shanghai Metals Market, LME aluminium met resistance at the five-day moving average and support at $2,100 per tonne last night. SMM expects the contract to trade at US$2,095-2,115 per tonne today.

As on March 13, LME aluminium cash (bid) price stands at US$ 2079.50per tonne, LME official settlement price stands at US$ 2080 per tonne; 3-months bid price stands at US$ 2100 per tonne, 3-months offer price is US$ 2101 per tonne; Dec 19 bid price stands at US$ 2155 per tonne, and Dec 19 offer price is US$ 2160 per tonne.

The LME aluminium opening stock has dropped to 1301700 tonnes with the moving of stocks in the Asian warehouses after the Chinese New Year. Live Warrants totalled at 1058350 tonnes, and Cancelled Warrants were 243350 tonne.

LME aluminium 3-months ABR price is hovering at US$ 2092.10 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange fell down from US$ 2183 per tonne on March 13 to US$ 2172 per tonne on March 14, while the market is abuzz with trade tensions between China and the U.S.

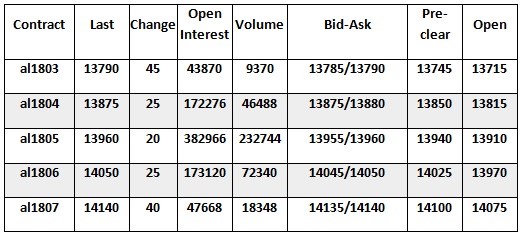

SHFE aluminium remains weak as high social inventories drove more short bets into the market. According to SMM, SHFE aluminium met resistance at RMB 13,970 per tonne overnight as investors cut their long positions. Prices will continue to face pressure in the short term unless there is support from downstream demand or inventories drop with more stocks moving to the market. SHFE aluminium will trade at RMB 13,800-13,980 per tonne today with spot discounts at RMB 70-30 per tonne. Following is the SHFE aluminium price movement on March 12, as updated by shfe.com.

Following the departure of US Secretary of State Rex Tillerson from the White House, the US dollar index touched a five-day low of 89.58 and then hovered around 89.6, while most base metals climbed up, aluminium edged down. Key factors to watch today include China’s economic data, the US retail sales data, the producer price index (PPI) and the Energy Information Administration's (EIA) data on crude oil inventories. The US dollar is likely to remain rangebound with downward room and so are the base metals.

Source: http://www.alcircle.com/- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.