Your Location > Home > News & Market >International News > Falling Alumina Prices: Alcoa’s Pain, Century Aluminum’s Gain

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

Falling Alumina Prices: Alcoa’s Pain, Century Aluminum’s Gain

- China Aluminium Network

- Post Time: 2015/12/22

- Click Amount: 420

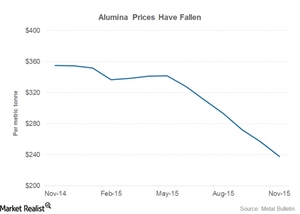

Falling alumina pricesAs discussed in the previous part, several aluminum producers have been turning to the API (alumina price index) in a bid to unlink their business from aluminum price volatility. In this part of the series, we’ll explore the recent trend in alumina prices.

Impact on Century AluminumThe graph above shows the trend in benchmark alumina prices as estimated by the Metal Bulletin. Alumina prices fell steeply as you can see. Currently, benchmark alumina prices are quoted in the ballpark of $200 per metric ton according to Metal Bulletin. This means that alumina shed more than $50 per metric ton since October when Century Aluminum (CENX) announced its production curtailment.Falling aluminum prices could lead to lower unit production costs of $100 per metric ton for Century Aluminum as almost two metric tons of alumina go into producing one metric ton of aluminum. As Century Aluminum sources alumina entirely from third parties, it stands to benefit from the steep fall in alumina prices. Lower alumina prices could be another reason for why Century is running the Sebree smelter at full capacity despite sagging aluminum prices.Impact on AlcoaHowever, Alcoa stands to lose from falling alumina prices. Firstly, all the aluminum that Alcoa produces uses alumina from its captive alumina refineries. Secondly, Alcoa (AA) also sells alumina to third parties. Alcoa has also been moving away from aluminum-based pricing to the API for its Alumina division. It currently prices ~75% of its alumina based on the API.In the first nine months of 2015, Alcoa’s Alumina segment generated the highest year-to-date profitability since 2007. This was because alumina prices held steady despite falling aluminum prices.However, with alumina prices falling steeply over the last couple of months, Alcoa’s Alumina segment could be negatively impacted. Rio Tinto (RIO) and Norsk Hydro (NHYDY) also sell alumina along with primary aluminum. These companies’ alumina operations could also be negatively impacted by falling alumina prices.Investors looking at direct exposure to aluminum can also consider the PowerShares DB Base Metals ETF (DBB). DBB invests a third of its holdings in aluminum.You can also read “A Comparative Analysis of the Aluminum Industry” to explore more about different companies in the aluminum value chain.Browse this series on Market Realist:

- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.