Your Location > Home > News & Market >International News > LME Aluminum Inventory Continues to Head Southward

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

LME Aluminum Inventory Continues to Head Southward

- China Aluminium Network

- Post Time: 2015/9/2

- Click Amount: 465

LME aluminum inventory

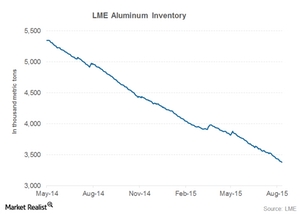

Previously in this series, we discussed the falling trend in aluminum prices as well as physical premiums. Now, we’ll analyze how aluminum inventories moved in July. The total aluminum inventory for LME-registered (London Metals Exchange) warehouses stood at 3.37 million tonnes on August 11.

Inventory continues to head southward

The above chart shows the trend in the LME aluminum inventory. Inventory levels have been falling after hitting ~5.5 million metric tons in mid-2013. The total aluminum inventory fell by 145,550 metric tons in July while the on-warrant inventory rose by 24,325 metric tons.

The warrants are canceled when the bearer of these warrants requests the physical delivery. At that point, the warrants aren’t available for trading. It’s important to note that the inventory levels in warehouses aren’t affected by canceled warrants. The inventory levels are affected only by the physical movement of the metal.

What does falling aluminum inventory mean?

The decrease in LME aluminum inventories implies that metal has essentially moved out of LME warehouses either to end users or to non-LME-registered warehouses. There have been concerns that a lot of aluminum is flowing to non-LME-registered warehouses because they charge less rent.

Movement of the metal to end buyers is a good sign for the aluminum industry. But if the metal is moving to another warehouse, it’s basically an inventory reshuffling exercise. Unfortunately, we don’t have any data as to where metal goes from LME warehouses. We also don’t have any official data regarding aluminum inventory with non-LME registered warehouses.

Indicators of the Chinese economy should be closely analyzed by investors in the metals and mining industry (XME). China (FXI) is a major market for miners including Rio Tinto (RIO), BHP Billiton (BHP), and Teck Resources (TCK). In the next part of this series, we’ll analyze the Chinese economy’s recent indicators.

Source: http://finance.yahoo.com/news/lme-aluminum-inventory-continues-head-220551560.html;_ylt=AwrC1CpxhuZV- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.