Your Location > Home > News & Market >International News > Lower Aluminum Prices Dint Alcoa’s 1Q 2015 Earnings

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

Lower Aluminum Prices Dint Alcoa’s 1Q 2015 Earnings

- China Aluminium Network

- Post Time: 2015/4/15

- Click Amount: 455

Lower aluminum prices

Previously, we discussed how moving to the API (alumina price index) boosted earnings in Alcoa’s (AA) alumina segment. Its primary metals segment, which produces aluminum, doesn’t have that advantage. Aluminum prices on the LME (London Metal Exchange) act as a reference point for pricing aluminum. Alcoa prices its aluminum with a 15-day lag to LME aluminum prices. Its 1Q earnings lost $84 million due to a decline in aluminum prices.

1Q earnings

Alcoa’s primary metals segment after-tax operating income was $187 million in 1Q, down 30% over 4Q 2014. The segment posted a loss of $15 million in 1Q 2014. Along with lower aluminum prices, this segment was hit by lower energy sales in Alcoa’s Brazilian operations.

Alcoa has curtailed all of its smelting capacity in Brazil (EWZ) and sells the electricity from its captive power plants in open markets. The Brazilian government has capped the electricity price at 388 Brazilian real, or BRL, per megawatt-hour. The earlier cap was 822 BRL. Lower energy prices negatively impacted Alcoa’s 1Q earnings.

Alcoa sold its stake in the Mt. Holly smelter to Century Aluminum (CENX) last year. Its aluminum production in 1Q came down as a result of this action.

Outlook

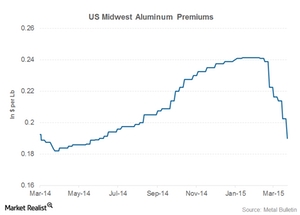

Aluminum premiums have corrected sharply over the last couple of months. This can be seen in the previous chart. Alcoa expects lower aluminum premiums to have a negative impact of $65 million on its primary metals segment 2Q earnings. Companies such as Vale (VALE) and BHP Billiton (BHP) are also negatively impacted by lower physical aluminum premiums. BHP currently forms 6.9% of the iShares Global Materials ETF (MXI).

Source: http://finance.yahoo.com/news/lower-aluminum-prices-dint-alcoa-010627251.html;_ylt=AwrC1jHD_S1V11kAq- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.