Your Location > Home > News & Market >International News > Aluminum Price Forecast 2015

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

Aluminum Price Forecast 2015

- China Aluminium Network

- Post Time: 2014/12/27

- Click Amount: 345

If you're looking for a 2015 aluminum price forecast, and landing on MetalMiner for the first time, we must warn you: we don't forecast prices. But we do something so much more valuable.

When it comes to forecasting metal prices, one of MetalMiner's core beliefs rests on the need to analyze metals markets within the broader context of commodities markets - not in a vacuum.

We've excerpted the following section from our recent report, "2015 Metal Buying Outlook: What Can We Expect for Base Metal and Steel Prices Over the Next 12 Months?"

MetalMiner's Aluminum Price Outlook 2015

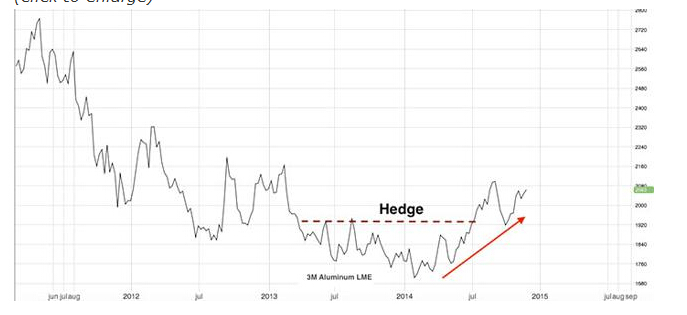

Aluminum could be called the "MVP" of industrial metals this year. We recommended that our members start hedging aluminum in June when LME 3-month prices were at $1,950/mt.*

Aluminum experienced big gains this year, and its price has held up well in this last quarter, proving there is strong investor appetite for this base metal.

Strong fundamentals remain in place as increasing use of the lightweight metal in car manufacturing pushes global demand growth while producers continue to cut output.

Price strength is not only seen in the raw material, but also in aluminum stocks. Alcoa Inc. is again at its highest levels in 4 years, and it could soon break through to its highest level since 2011.

Aluminum keeps outperforming the rest of the industrial metals and is now in a correction, curbing the gains experienced this year. Based on current trends, we believe the light metal could significantly increase in 2015. Although its upside potential will be limited while commodities keep falling, we recommend buyers stay hedged as long as prices remain strong.

- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.