Your Location > Home > News & Market >International News > Aluminum company metrics compared

Today' Focus

-

Hangzhou Jinjiang Group's general manager Zhang Jianyang, vice general manager Sun Jiabin and their team had attended the SECOND BELT AND ROAD FORUM FOR INTERNATIONAL COOPERATION, they also attended the signing ceremony of comprehensive strateg...

International News

Domestic News

International News

Aluminum company metrics compared

- China Aluminium Network

- Post Time: 2014/10/9

- Click Amount: 390

Comparing aluminum companies

Previously in this series, we described the value chain in the aluminum industry, and where various companies are placed in it. In this article, we’ll analyze aluminum companies using select financial metrics. Let’s find out how a company’s place in the aluminum value chain impacts its financial performance.

Key metrics in the aluminum sector

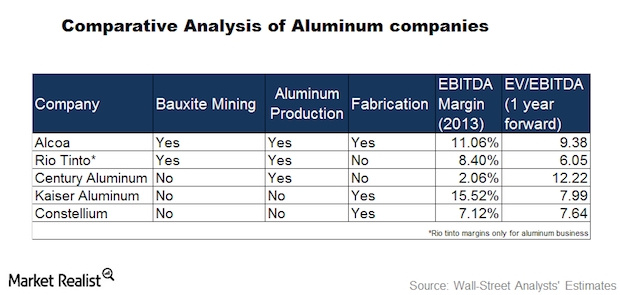

The chart above shows the key metrics for aluminum companies. As you can see, Alcoa Inc (AA) is an integrated player, while Kaiser Aluminum Corp. (KALU) and Constellium N.V. (CSTM) are downstream players. Rio Tinto (RIO) is a pure-play primary producer, while Century Aluminum Co (CENX) is more of a midstream player.

Why profit margins of aluminum companies diverge

The chart above shows the earnings before interest, taxes, depreciation, and amortization (or EBITDA) margins for aluminum companies. The data are for the year ended 2013. As you can see, Kaiser Aluminum has the highest margins, while Rio Tinto has the lowest margins among aluminum companies. This is mainly because of different business strategies. Pure-play fabricators such as Kaiser Aluminum and Constellium sell value-added products. These products sell at higher prices than primary aluminum.

Trading on the London Metal Exchange determines the price for primary aluminum. Any increase in the price of aluminum benefits companies that produce primary aluminum. As noted, Alcoa, Rio Tinto, and Century Aluminum produce primary aluminum.

Fabricators such as Kaiser Aluminum and Constellium purchase aluminum from outside suppliers. Their unit cost of production increases when aluminum prices rise. So, a rise in aluminum prices benefits RIO, CENX, and AA. On the flip side, KALU and CSTM benefit from a fall in aluminum prices. Retail investors can add exposure to the metals industry with the SPDR S&P Metals and Mining ETF (XME).

Pure-play fabricators such as Constellium take certain steps to protect their profit margins from volatility in aluminum prices. Let’s look at this in greater detail in the next article.

Source: http://finance.yahoo.com/news/aluminum-company-metrics-compared-210022952.html;_ylt=AwrBJSCkUTZUBhYA- Copyright and Exemption Declaration :①All articles, pictures and videos that are marked with "China Aluminum Network" on this website are copyright and belong to China

Aluminium Network (www.alu.com.cn). When transshipment, any media, website or individual must list the source from "China

Aluminium Network (www.alu.com.cn)". We seek legal actions against anyone that disobey this.

②Articles that marked as copy from others are for transferring more information to readers, do not represent or endorse their opinions or

accuracy and reliability. When other media, website or individuals copy from our website, must keep the source. Anyone that changes the

articles' sources will hold the responsibilities for copyright and law problems. We also seek legal actions against anyone that disobey

this.

③If any articles copied by our website concern the copyright and other problems, please contact us within one week.